Paycard Compliance & Security

Help keep ahead of compliance. Wisely enables compliance with federal and state regulations in all 50 states. Wisely also has several security features — including EMV chip, multi-factor authentication for sensitive actions, Visa or Mastercard zero-liability policies, and geo-fencing technology — to help protect members from fraud if the card is lost or stolen (1,2).

1. Visa's Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify ADP immediately of any unauthorized use. Under MasterCard’s Zero Liability Policy, your liability for unauthorized transactions on your Card Account is $0.00 if you notify us promptly upon becoming aware of the loss or theft, and you exercise reasonable care in safeguarding your Card from loss, theft, or unauthorized use. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

2. Your funds are protected from fraud if your card is lost or stolen. You must notify us immediately and assist us in our investigation if your card is lost or stolen or you believe someone is using your card without your permission. For more information, please review your cardholder agreement by logging in to the myWisely app or online at mywisely.com.

Single Payments Provider

Power your whole wage payment operation with one provider. Wisely can help you cut down on unnecessary steps and vendors by turning to a single provider for a wide variety of pay expectations, including paycards, direct deposit, on-demand and off-cycle pay, pay statements, W-2s—and, yes, even paper checks when you need them.

Off-Cycle Payments

Compliant, on-demand pay — for termination and off-cycle wages — is available through Wisely. The need to pay employees on an ad hoc basis between regular paydays has grown. Wisely gives you the power to efficiently handle these payments.

Wisely can help you with:

- Compliance Enablement: Wisely is designed for compliance in all 50 U.S. states.

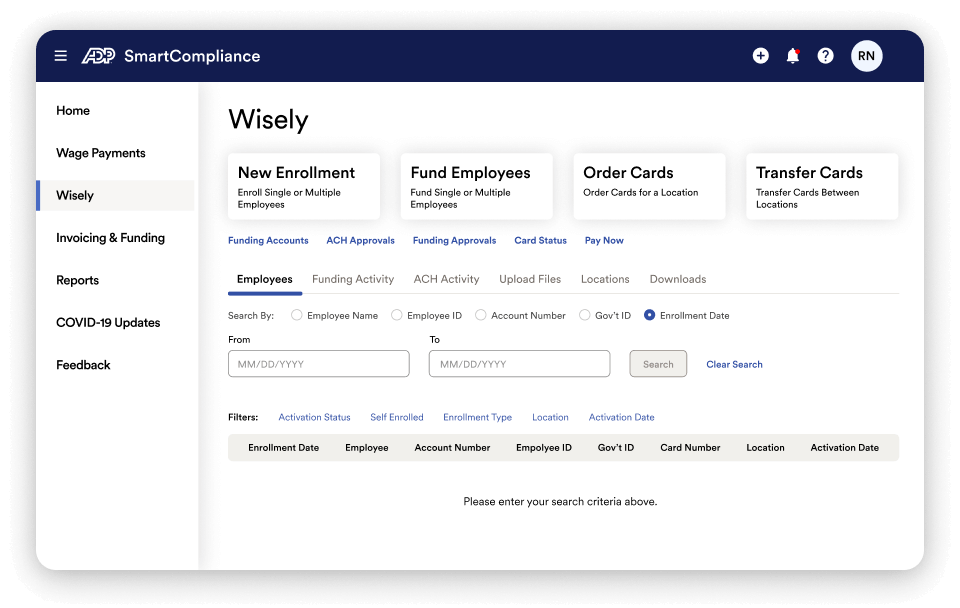

- Operational Efficiency: Reduce the hassle of coordinating between various departments, managers and payroll resources with a single interface that allows you to manage all your off-cycle pay needs, offering multiple ways to pay your employees.

- Easy Administration: You can transfer funds virtually instantly to employees and view your funding account balances so you have complete control over the process.

Paperless Pay

Issuing paper checks comes with overhead and takes time. Wisely’s convenient administrative portal helps you efficiently manage your card program, so paying your people becomes faster, easier* and more secure.

* Faster and easier access to funds is based on comparison of traditional banking policies and deposit of paper checks versus deposits made electronically and the additional methods available to access funds via a Card as opposed to a paper check.

Gratuity and Tips Management

Managing tips can be easy. Wisely enables you to pay tips virtually instantly on the Wisely card to help streamline and automate gratuity payments for your business — and your workers.

Using Wisely to pay tips can help:

- Mitigate risk: Use a secure way to pay tips to workers and reduce the need for cash on hand.

- Enhance employee experience: Provide workers quick access to their funds or the ability to make online or in-person purchases, using their Wisely card.

- Reduce time: Managers can enroll employees and fund Wisely cards within seconds, securely transferring tips at the end of a shift or at the frequency you want.

Program Adoption Support

Support to ensure paycard program success is available whenever you need it. Employees can enroll in just a few clicks, and you can improve the employee experience by providing immediate, compliant pay with a virtual Wisely paycard, meaning your company can move toward 100% paperless payroll quickly and easily. And you have access to educational and promotional tools that help you reach your card adoption goals.

Employee Financial Wellness

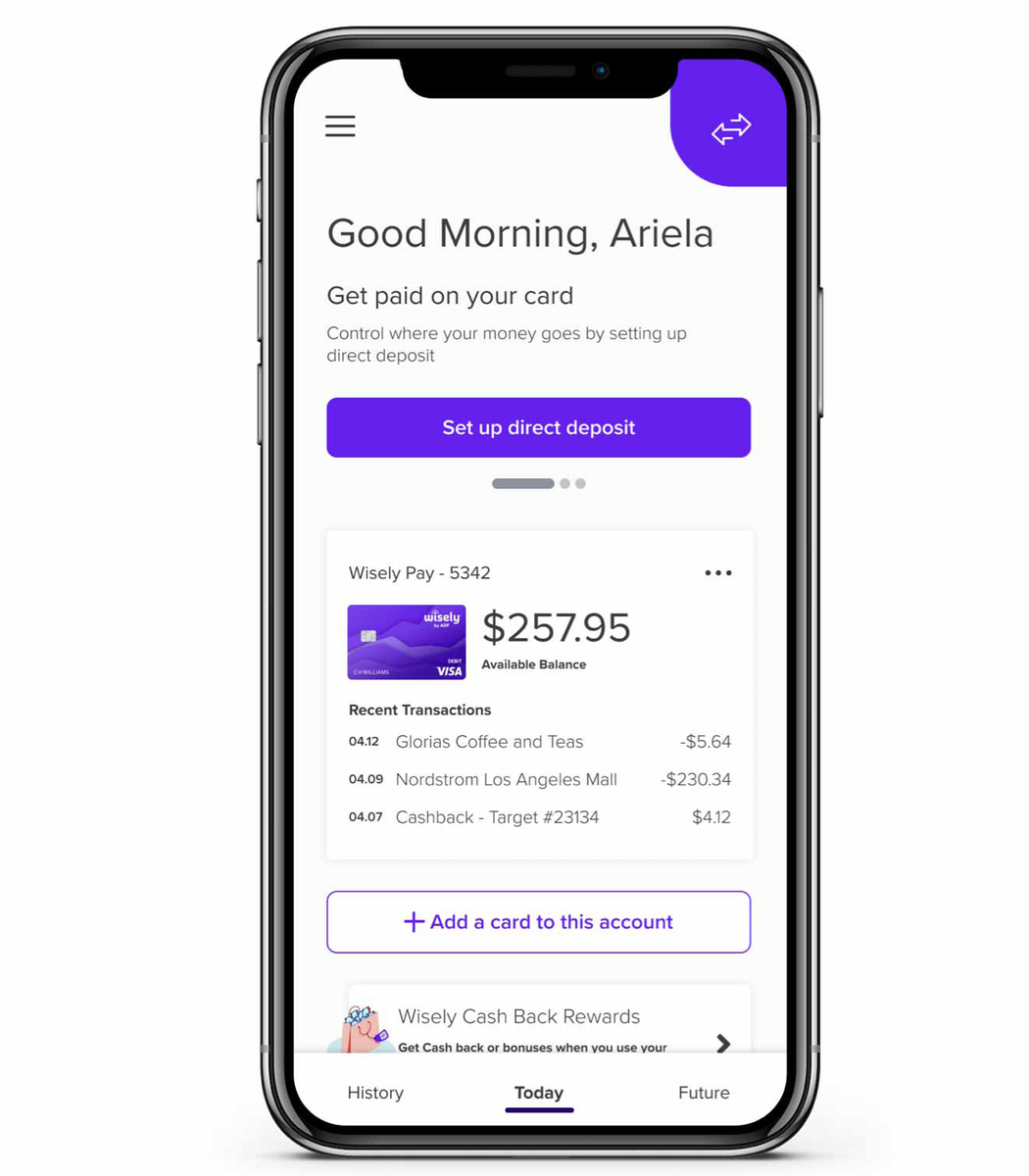

Give your workers the financial control and support they deserve. With Wisely, workers can skip the hassle of paper checks and manage their money wherever they are. There’s no cost (1,2) to sign up, no hidden fees (2) and no credit check needed (3).

Additionally, your workers now have the power to:

- Manage their money: Keep track of their account balance 24/7 and categorize spending so they can see where their money is going.

- Protect their account: Know their balance is protected from fraud (if the card is lost or stolen (7)) along with other security features, including instant card lock, purchase protection and travel alert notifications.

- Grow their savings (6): With the app, it's easy to save money at their own pace and on their own terms (6).

- Get cash: Enjoy surcharge-free ATM withdrawals at tens of thousands of ATM locations nationwide (5).

- Shop and pay bills: Pay with a single touch when they add Wisely® to their mobile wallet. Compatible with Apple Pay®, Google Pay™ and Samsung Pay®.

- Get early direct deposit (4): Get paid up to two days early with direct deposit for pay and other sources of income at no extra cost.

- (5)The number of fee-free ATM transactions may be limited. Please log in to the myWisely app or mywisely.com and see your cardholder agreement and list of all fees for more information. Standard message and data rates may apply.

(6)Amounts transferred to your savings envelope will no longer appear in your available balance. You can transfer money from your savings envelope back to your available balance at any time using the myWisely app or at mywisely.com.

(7)Your funds are protected from fraud if your card is lost or stolen. You must notify us immediately and assist us in our investigation if your card is lost or stolen or you believe someone is using your card without your permission. For more information, please review your cardholder agreement by logging in to the myWisely app or online at mywisely.com. - (3)The Wisely card is a prepaid card. The Wisely card is not a credit card and does not build credit.

(4) You must log in to the myWisely app or mywisely.com to opt-in to early direct deposit. Early direct deposit of funds is not guaranteed and is subject to the timing of payor’s payment instruction. Faster funding claim is based on a comparison of our policy of making funds available upon our receipt of payment instruction with the typical banking practice of posting funds at settlement. Please see full disclosures on mywisely.com or the myWisely app. - (1)Visa's Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Cardholders must use care in protecting their card and notify ADP immediately of any unauthorized use. Under MasterCard’s Zero Liability Policy, your liability for unauthorized transactions on your Card Account is $0.00 if you notify us promptly upon becoming aware of the loss or theft, and you exercise reasonable care in safeguarding your Card from loss, theft, or unauthorized use. These provisions limiting your liability do not apply to debit transactions not processed by MasterCard or to unregistered cards.

(2)To view applicable fees, please log in to the myWisely app or mywisely.com to see your cardholder agreement and list of all fees for more information.